Following a modest rally yesterday in response to soft inflation numbers, U.S. stocks are once again dropping significantly today, dragging bitcoin (BTC) down with them.

At midday on the east coast, the Nasdaq is down 1.7% and the S&P 500 is down 1.2%. After reaching nearly $85,000 on Wednesday, bitcoin has fallen back to $81,000, a 1% decrease over the past 24 hours.

On the other hand, gold continues its traditional role as a safe haven during times of turmoil. The price of gold has increased by 1.5% to a new record high, approaching $3,000 per ounce for the first time ever.

Over the past three weeks since the Nasdaq’s peak for the year, the index has dropped by almost 15%. During the same period, gold has seen a 1% increase while bitcoin has dropped by nearly 20%.

The current trend may remind investors of the late summer and early fall of 2024, when crypto markets and stocks moved sideways while gold reached new highs. While BTC traded between $50,000 and $70,000 from March to October, gold surged by almost 40% to $2,800. Eventually, bitcoin surpassed $100,000 after Trump’s election victory, while gold’s gains slowed as money shifted from safe havens to risky assets.

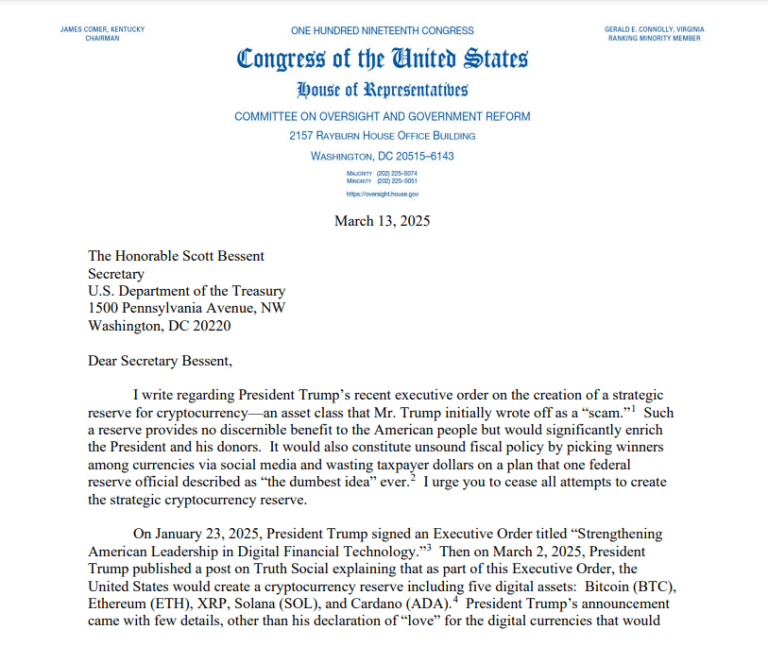

Notably, gold exchange-traded funds have experienced their largest 30-day average inflows since early 2022, adding 3 million ounces of gold to the funds, according to data from Bold.report.

Gold ETF inflows (Bold.report)

In contrast, U.S.-listed spot bitcoin ETFs have experienced $5 billion in outflows since February, marking the longest negative streak in their one-year history, according to data from SoSoValue.