Many people tend to rejoice during times of low feerates. It’s an opportunity to tidy up, consolidate any UTXOs that are necessary, open or close any Lightning channels that have been pending, and perhaps even embed a whimsical 8-bit jpeg into the blockchain. These periods are often seen as favorable.

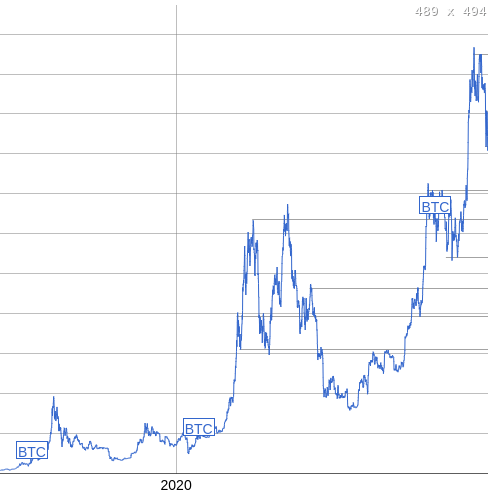

However, they are not. Recently, we’ve witnessed a dramatic increase in price, finally reaching the significant milestone of 100k USD, a target that many assumed was inevitable during the previous market cycle. This is not typical.

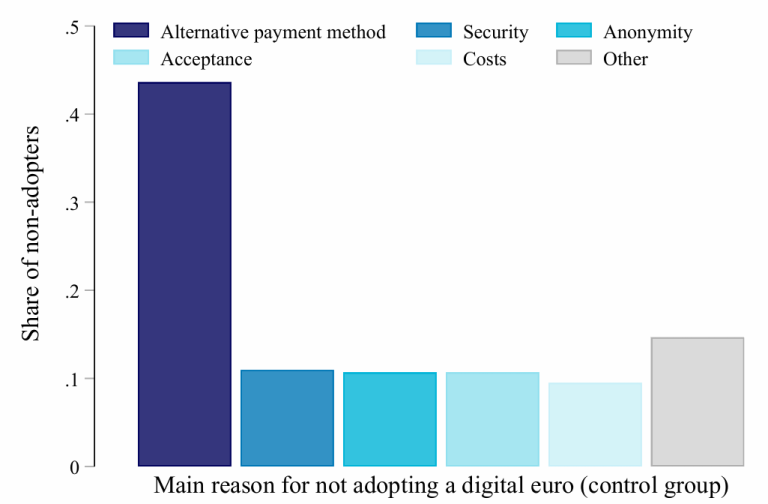

The image on the left illustrates the average feerate per day since 2017, while the image on the right shows the average price per day over the same period. Historically, when prices surged and were highly volatile, feerates tended to spike as well, generally aligning with price growth and peaking alongside it. At that time, individuals actively engaged in buying and selling on-chain, and people took control of their coins upon purchasing them.

This recent surge to over 100k does not appear to have had the same proportional impact on feerates as previous movements within this cycle. Now, upon examining both charts, some might question whether this cycle is concluding. It’s a possibility, but let’s consider the opposite scenario for a moment.

What else might this suggest? It indicates that the market participants are evolving. Previously dominated by individuals who self-custodied, managed counterparty risks by withdrawing gains from exchanges, and generated timely on-chain activity, the market is now shifting towards individuals merely exchanging ETF shares without the need for on-chain settlements.

This shift is concerning. Bitcoin’s essence is defined by users who directly interact with the protocol. Those possessing private keys to authorize transactions generate revenue for miners. Those receiving funds and verifying transactions against consensus rules using software.

Transferring these responsibilities from users to custodians threatens the stability of Bitcoin’s nature.

This presents a serious existential challenge that must be addressed. The entirety of consensus stability around a specific set of rules relies on the assumption that there are enough independent actors with diverging interests, yet aligned by a shared value in using those rules. The smaller the group of independent actors (and the larger the group “using” Bitcoin via intermediaries), the easier it becomes for them to coordinate fundamental changes, increasing the likelihood that their collective interests diverge from the broader group’s interests.

If this trend continues, Bitcoin may fail to embody the ideals that many of us hope for today. This problem is both technical, involving Bitcoin’s scaling to allow users to retain control of their funds on-chain, even as a last resort, and one of incentives and risk management.

The system must not only scale but also provide ways to mitigate self-custody risks to a level people expect from traditional finance. Many users genuinely require this assurance.

This isn’t merely a case of “do as I do because it’s the right way.” It has long-term implications for Bitcoin’s foundational properties.

This article is a Take. The opinions expressed are solely those of the author and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.