Michael Saylor, you were forced to realize that all the store-of-value assets are defective and pushed you to focus on the only asset that is not. That does not make you immune to seeing the medium of exchange case. You will see how the housing market is huge when you watch it from one point of view and horrible from another. But if you experience pain driving you to keep your billions of dollars purchasing power, housing is a decent tool to keep it.

Your SoV obsession misses the mark—badly. The biggest aspect of Bitcoin is the medium of exchange. Even though the fiat system increasingly separates money’s functions, that doesn’t mean it should. I get that saying Bitcoin is a medium of exchange is kicking the hornet’s nest, and all the other currency lords will try to stop Bitcoin. It’d be great if they joined in instead of fighting it. That will give all the billionaires certainty that they can put money in it, but simply using Bitcoin just to store value is attacking it. That approach will turn it into digital gold 2.0, captured.

There’s no store of value without a medium of exchange! The medium of exchange comes first. You receive a transaction, then you store the Bitcoin. If the store of value were the main point, imagine announcing you lost your keys for your Bitcoin stack—you’d still store it perfectly, but without the medium of exchange function, the market will wipe out the fictional fiat value layered on top. That value is there exactly because it can move and still can be used as a medium of exchange.

An oxygen tank is vital for reserves, but breathing matters more. The store of value is secondary and relies on the ability to transact. Without that, the store of value means nothing. Michael, you learned this firsthand when your million-dollar holdings in Argentina were diluted by 90%. You struggled to preserve the value not because you did not see it coming but because you couldn’t use it as a medium of exchange. True, a poor store of value weakens the medium of exchange, but why does the latter take priority? Because the ability to exchange is what lets you respond.

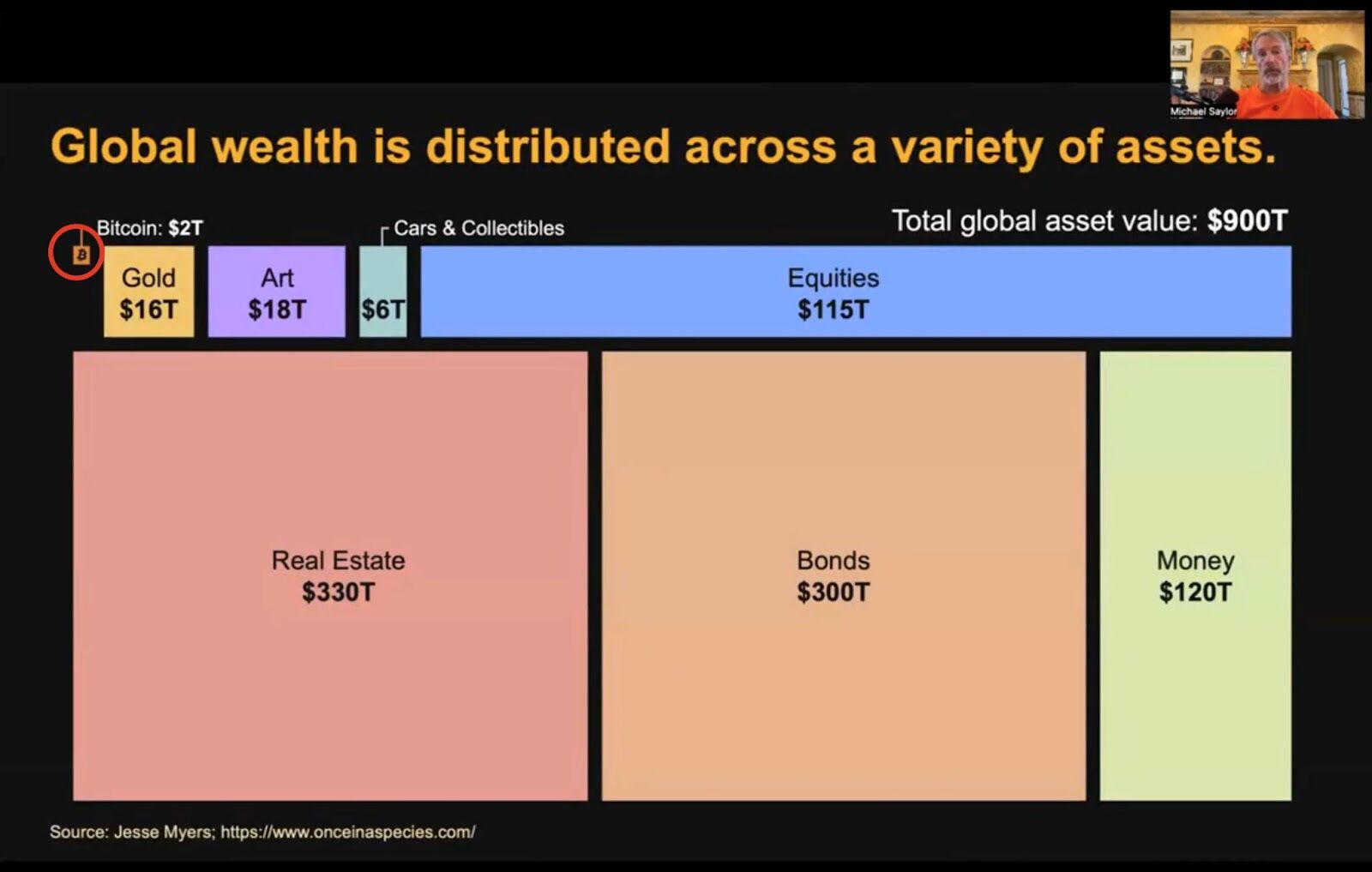

By now, most people exposed to Bitcoin know the chart from Jesse Mayers that you popularized. You claim there’s no better idea than a $900 trillion clean store of value, then immediately call Bitcoin one of the world’s most liquid markets, running 24/7/365. Guess what? Liquidity means medium of exchange.

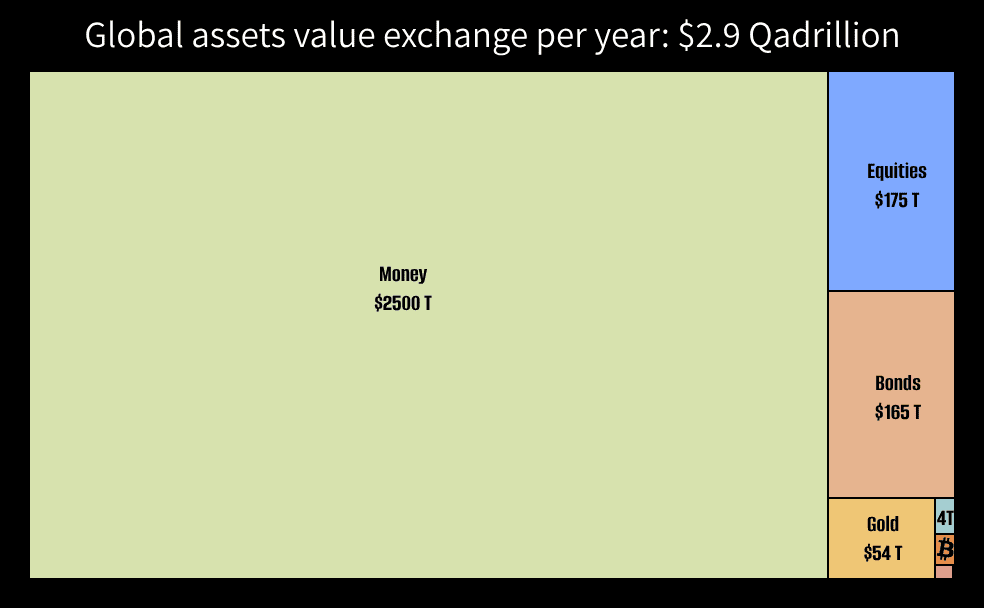

Now, let’s break down the Jesse chart, starting with the housing market. It’s valued at $330 trillion, but it’s such a poor medium of exchange that it only trades for $1.3 trillion annually. Regulations and taxes make trading real estate even tougher. Still, since it’s more than 100 times better as a store of value, billionaires prize it, increasingly dominating the market and pricing out younger generations.

A house might be valuable, but its worth grows not just from what it is but from its ties to nearby utilities. Build a road to it, and the value rises. Add a superstore or a gas station, or connect it to the electrical grid, and the value climbs again. The network creates opportunities for energy to flow into the area, boosting the chance to capture that energy as economic value, like money. So the exchanges that happen in the network are what increases the value of a house. But I see the flip side: if you’re a billionaire and everyone’s after your resources, you don’t want a big network around your house. You’d prioritize privacy instead. The house might lose value, but the goal shifts to raising the cost for others to reach you, reducing the chance to be attacked.

What about the bond market? Bonds are valued at $300 trillion as a store of value, with $140 trillion traded yearly plus $25 trillion in new bond issuance. That means the medium of exchange value is about 50% of its total value annually. It’s better than houses in that sense, but the numbers still show people primarily use it as a store of value.

Next up are equities. Valued at $115 trillion, they were traded for about $175 trillion. This shows their strength as a medium of exchange exceeds their store of value role. Take your MicroStrategy stock—you know it better than anyone. How much value did it store last year, and how much was exchanged through it?

The next two sections are interesting. The art industry’s yearly transactions are so minor that they don’t even register on the chart. Meanwhile, the cars and collectibles sector sees trading volumes of nearly $4 trillion annually. This highlights that they’re mostly seen as a store of value each year, but it also reveals how poorly the housing market performs as a medium of exchange—outdone even by the car market.

Ooooh gold! Gold bugs rave that it’s been around for over 5,000 years, calling it the ultimate store of value for whatever reason—yet it’s just 1.78% of the store of value market. This shows that once its medium of exchange role was stripped away, it became vulnerable to capture and manipulation. Sorry, gold bugs, that genie’s not going back in the lamp. Gold holds $16 trillion in value, and the gold bugs claim it could store the $120 trillion worth of money in it. They’re desperate to pump their bags, but the market disagrees, valuing the defective fiat money ten times higher than the shiny, lifeless rock. Is gold a better medium of exchange, then? It trades at $54 trillion yearly, boosted by derivatives, making its medium of exchange use 3.5 times its store of value role.

Money might not dominate as a store of value among assets, but it’s the leading medium of exchange by far. Other stores of value assets don’t even come close. What if the dollar, the top currency, became just a store of value? It would collapse the USD network, boosting the value of non-US assets as their networks step in to meet the demand. Over time, their store of value assets would rise while USD assets would plummet. Global money totals around $120 trillion, but look at the top central banks’ transaction volumes: Fedwire at ~$1,182 trillion, TARGET2 at ~$765 trillion, CHAPS at ~$145 trillion, and others (partial) at ~$500 trillion (a conservative estimate due to incomplete data). So, while the store of value is $120 trillion—per the Jesse chart—the medium of exchange utility of these networks is over 20 times greater, which is around ~$2.5 quadrillion. What would the medium of exchange value be if 2 billion unbanked people were included? How many more transactions would that spark? And what if microtransactions were possible?

Where does Bitcoin fit into all of this? The prevailing narrative urges holders never to sell, positioning Bitcoin solely as a store of value. Yet, the market tells a different story. In 2024, Bitcoin’s market cap hit $2 trillion, while the value exchanged on its first layer—the blockchain—reached $3.4 trillion. Factor in the Lightning Network (though its exact figures remain elusive), and the total likely approaches $4 trillion. This suggests that Bitcoin’s role as a medium of exchange is twice as significant as its store-of-value function. So, what happens if that long-standing “hold forever” propaganda narrative begins to fade?