Crypto traders are accustomed to observing a surge in prices of less serious cryptocurrencies like dogecoin (DOGE) as an indicator of market froth. Interestingly, XRP, the payments-focused cryptocurrency, seems to also serve as a signal for bull-market peaks in bitcoin (BTC).

Unlike meme tokens such as DOGE and shiba inu (SHIB), XRP has actual utility. Ripple uses it to facilitate cross-border transactions, setting it apart from meme coins.

Since 2017, XRP has acted as a contrary indicator for bitcoin bulls, often rallying— sometimes skyrocketing hundreds of percent in a short period— in the final stages of BTC bull runs, marking the point at which bitcoin peaks.

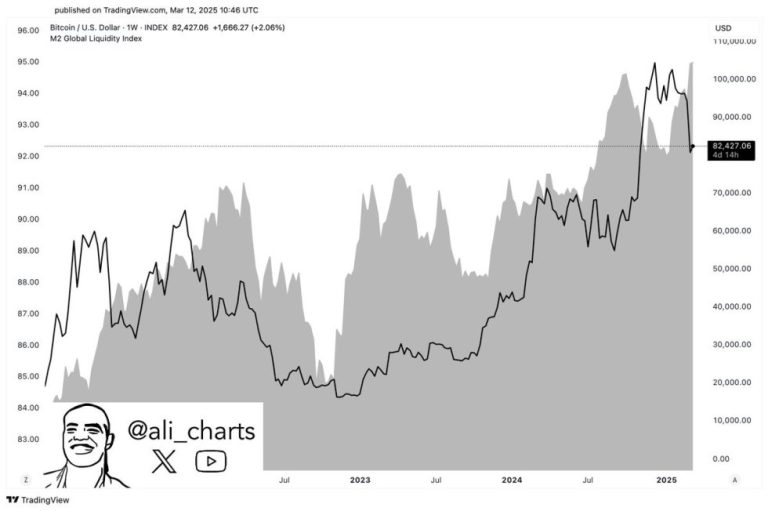

XRP vs BTC price comparison since 2017. (TradingView/CoinDesk)

Between December 2017 and early 2018, XRP witnessed an impressive tenfold rally, coinciding with bitcoin’s peak around $20,000, before entering a nearly year-long bear market.

A similar rapid spike in XRP occurred in early 2021, signaling the peak of another bitcoin bull market. Additionally, XRP’s surge of around 240% in late 2024 foreshadowed bitcoin’s bull market peak surpassing $109,000, followed by a drop below $80,000.

As the saying goes: “Once is happenstance, twice is a coincidence, and three times is a trend.”

For the next BTC bull run, traders may want to monitor XRP for potential signals indicating the end of the bullish trend.