Memecoins have been making headlines recently, especially with the launch of the President’s $Trump coin. The U.S. SEC clarified that memecoins are generally not considered securities as they do not meet the Howey test. However, clients may still have questions about these assets.

In today’s crypto for advisors, Janine Grainger from Easy Crypto in New Zealand breaks down what memecoins are, how they function, and the associated risks. Following that, Kieran Mitha, a next-gen investor, answers questions about learning about memecoins in Ask an Expert.

– Sarah Morton

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Memecoins: Boom, Bust and Billion-Dollar Bets

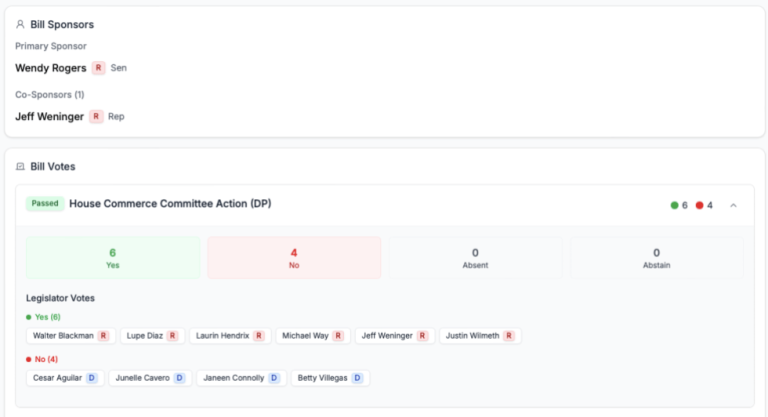

Recently, a new meme coin named $Trump was launched by the President-Elect. Its market value surged to $14.5 billion within two days but then plummeted by two-thirds. The entities behind the coin reportedly earned nearly $100 million in trading fees in under two weeks (and even more from liquidations). However, hundreds of thousands of average investors suffered significant losses. Additionally, in late 2024, when Trump announced a Department of Government Efficiency (DOGE), the cryptocurrency Dogecoin saw a 150% surge, surpassing bitcoin’s gains.

Instances like these have firmly placed meme coins on the investment radar. However, driven by hype rather than utility, they present both opportunities and risks for investors, and financial advisors must grasp their unique market dynamics, as high-net-worth clients may inquire about them despite their speculative nature.

Figure 1: CoinDesk view of $TRUMP which plummeted shortly after launch.

What are memecoins?

Memecoins are cryptocurrencies that stem from internet culture, social media trends, or jokes. Unlike bitcoin or ether, which have gradually justified inclusion in diversified portfolios, memecoins thrive on hype, community sentiment, and celebrity endorsements. While they often begin as parodies or jokes, viral marketing and speculative trading can give them significant momentum — albeit usually short-lived.

Why meme coins matter

Memecoins have garnered mainstream attention due to their cultural significance and potential for substantial short-term gains. Figures like Elon Musk have fueled rallies with a single tweet, attracting speculative interest. However, while traders are enticed by the prospect of rapid wealth accumulation, meme coins are high-risk assets prone to unpredictable price fluctuations.

The value of meme coins can surge or collapse within hours, resulting in substantial profits or losses, such as ‘Fartcoin,’ a jest token that attained a $2.2 billion market cap solely through viral appeal before crashing as initial investors exited. Platforms like Pump.fun exacerbate this speculation by enabling users to generate and trade meme coins with minimal technical expertise, leading to a surge of ephemeral tokens that underscore the market’s high-risk nature.

But are they legal?

Ironically, the Securities and Exchange Commission’s regulatory stance has facilitated the proliferation of memecoins. While utility-driven cryptocurrencies face scrutiny and legal obstacles, memecoins exist in a gray area as they do not guarantee financial returns, fueling their proliferation.

The dark side: rug pulls and scams

Regrettably, memecoins serve as breeding grounds for ‘pump-and-dump’ schemes, where influencers hype a token to inflate its price before cashing out, leaving ordinary investors with worthless holdings.

An example is viral internet personality Hailey Welch, who launched $HAWK after online notoriety. Within a day, the coin’s market cap approached half a billion dollars before collapsing, sparking allegations of fraud. Similarly, Argentina’s President Javier Milei inadvertently triggered a scandal by promoting $LIBRA, which also surged and crashed, exposing him to accusations of market manipulation. These incidents underscore why meme coins are often viewed as cryptocurrencies with minimal intrinsic value or long-term viability.

Figure 2: CoinDesk view of Hawk Tau ($HAWK), which plummeted shortly after launch.

Memecoin investment considerations

Investors should exercise caution as many memecoins lack transparency. For those still interested, key risk factors include:

- Liquidity: Low trading volumes result in extreme price fluctuations, making it challenging to enter or exit positions.

- Community sentiment: Social media influences price movements. Monitoring platforms like Twitter and Telegram can offer market insights.

- Tokenomics: Some memecoins create scarcity, while others have an unlimited supply, diluting value over time.

- Pump-and-dump risk: Tokens aggressively marketed with unrealistic promises often indicate a short-lived hype cycle rather than a sustainable investment.

- Early entry vs. longevity: Getting in early can be profitable, but the risk of a sudden crash is significant. Some investors prefer established memecoins with robust communities over chasing the latest trend.

While memecoins may yield quick profits, their volatility and susceptibility to manipulation make them high-risk assets. Advisors should educate clients on their speculative nature and stress the importance of proactive risk management. Ultimately, memecoins are more akin to gambling than traditional investing.

–Janine Granger, CEO, Easy Crypto

Ask an Expert

Q: I see people on social media getting rich from memecoins…Can I do the same?

A: While some individuals have made substantial profits from memecoins, it is crucial to remember that social media often highlights success stories while overlooking the many who incur losses. Memecoins are highly speculative, with prices driven by hype, celebrity endorsements like Elon Musk, and market sentiment rather than solid fundamentals.

If you are considering investing, approach it cautiously. Timing is critical — early buyers often see significant gains, while latecomers face losses when the hype fades or a rug pull occurs. If you choose to invest, treat it as a high-risk gamble rather than a guaranteed path to wealth. Never invest more than you can afford to lose, and always conduct thorough research before making any decisions.

Q. What role does community play in the success of a memecoin?

A: Community forms the foundation of any successful memecoin and influences overall sentiment toward the project. Unlike traditional investments where value is often linked to revenue or utility, memecoins thrive on social media presence, viral trends, and grassroots enthusiasm. A robust, engaged community can drive adoption and maintain project relevance, but without sustained interest, even popular memecoins can fade rapidly. Before investing, assess the community’s activity on platforms like Discord, and Reddit.

Q: How can I learn about memecoins before investing?

A: The most effective way to gain knowledge about memecoins is through thorough research and active participation in the community. Begin by following reputable cryptocurrency news sources, reviewing whitepapers, and engaging with forums like Twitter, Reddit, and Discord where communities discuss projects in real-time. Consider aspects such as the project’s website, roadmap, developer engagement, and tokenomics.

It is essential to understand the risks involved — memecoins are often characterized by high speculation, so acquainting yourself with market trends, trading strategies, and potential scams can help you make informed decisions. Do not rely solely on hype or social media influencers; conducting your due diligence is crucial.

–Kieran Mittha, crypto enthusiast & communications major

Keep Reading

- The U.S. Bitcoin Strategic Reserve, along with the Digital Asset Stockpile, were announced at the Whitehouse’s first Digital Asset Summit.

- In a statement released Friday, the Officer of the Comptroller of the Currency (OCC) told U.S. banks they can custody crypto alongside other assets.

- The U.S. Bitcoin Act of 2025 was introduced to the House on Tuesday.